Full employment, in macroeconomics, is the level of employment rates where there is no cyclical or deficient-demand unemployment. It is defined by the majority of mainstream economists as being an acceptable level of unemployment somewhere above 0%. The discrepancy from 0% arises due to non-cyclical types of unemployment, such as frictional unemployment (there will always be people who have quit or have lost a seasonal job and are in the process of getting a new job) and structural unemployment (mismatch between worker skills and job requirements). Unemployment above 0% is seen as necessary to control inflation in capitalist economies, to keep inflation from accelerating, i.e., from rising from year to year. This view is based on a theory centering on the concept of the Non-Accelerating Inflation Rate of Unemployment (NAIRU); in the current era, the majority of mainstream economists mean NAIRU when speaking of "full" employment. The NAIRU has also been described by Milton Friedman, among others, as the "natural" rate of unemployment. Having many names, it has also been called the structural unemployment rate.

The 20th century British economist William Beveridge stated that an unemployment rate of 3% was full employment. For the United States, economist William T. Dickens found that full-employment unemployment rate varied a lot over time but equaled about 5.5 percent of the civilian labor force during the 2000s. Recently, economists have emphasized the idea that full employment represents a "range" of possible unemployment rates. For example, in 1999, in the United States, the Organisation for Economic Co-operation and Development (OECD) gives an estimate of the "full-employment unemployment rate" of 4 to 6.4%. This is the estimated unemployment rate at full employment, plus & minus the standard error of the estimate.

The concept of full employment of labor corresponds to the concept of potential output or potential real GDP and the long run aggregate supply (LRAS) curve. In neoclassical macroeconomics, the highest sustainable level of aggregate real GDP or "potential" is seen as corresponding to a vertical LRAS curve: any increase in the demand for real GDP can only lead to rising prices in the long run, while any increase in output is temporary.

Maps, Directions, and Place Reviews

Economic concept

What most neoclassical economists mean by "full" employment is a rate somewhat less than 100% employment. Others, such as the late James Tobin, have been accused of disagreeing, considering full employment as 0% unemployment. However, this was not Tobin's perspective in his later work.

Some see John Maynard Keynes as attacking the existence of rates of unemployment substantially above 0%:

Most readers would interpret this statement as referring to only cyclical, deficient-demand, or "involuntary" unemployment (discussed below) but not to unemployment existing as "full employment" (mismatch and frictional unemployment). This is because, writing in 1929, Keynes was discussing a period in which the unemployment rate had been persistently above most conceptions of what corresponds to full employment. That is, a situation where a tenth of the population (and thus a larger percentage of the labor force) is unemployed involves a disaster.

One major difference between Keynes and the Classical economists was that while the latter saw "full employment" as the normal state of affairs with a free-market economy (except for short periods of adjustment), Keynes saw the possibility of persistent aggregate-demand failure causing unemployment rates to exceed those corresponding to full employment. Put differently, while Classical economists saw all unemployment as "voluntary," Keynes saw the possibility that involuntary unemployment can exist when the demand for final products is low compared to potential output. This can be seen in his later and more serious work. In his General Theory of Employment, Interest, and Money, chapter 2, he used a definition that should be familiar to modern macroeconomics:

The only difference from the usual definitions is that, as discussed below, most economists would add skill/location mismatch or structural unemployment as existing at full employment. More theoretically,Keynes had two main definitions of full employment, which he saw as equivalent. His first main definition of full employment involves the absence of "involuntary" unemployment:

Put another way, the full employment and the absence of involuntary unemployment correspond to the case where the real wage equals the marginal cost to workers of supplying labor for hire on the market (the "marginal disutility of employment"). That is, the real wage rate and the amount of employment correspond to a point on the aggregate supply curve of labor that is assumed to exist. In contrast, a situation with less than full employment and thus involuntary unemployment would have the real wage above the supply price of labor. That is, the employment situation corresponds to a point above and to the left of the aggregate supply curve of labor: the real wage would be above the point on the aggregate supply curve of labor at the current level of employment; alternatively, the level of employment would be below the point on that supply curve at the current real wage.

Second, in chapter 3, Keynes saw full employment as a situation where "a further increase in the value of the effective demand will no longer be accompanied by any increase in output."

This means that at and above full employment, any increase in aggregate demand and employment corresponds primarily to increases in prices rather than output. Thus, full employment of labor corresponds to potential output.

Whilst full employment is often an aim for an economy, most economists see it as more beneficial to have some level of unemployment, especially of the frictional sort. In theory, this keeps the labor market flexible, allowing room for new innovations and investment. As in the NAIRU theory, the existence of some unemployment is required to avoid accelerating inflation.

The Current Unemployment Rate Video

Historical measurement and discussion

For the United Kingdom, the OECD estimated the NAIRU (or structural unemployment) rate as being equal to 8.5% on average between 1988 and 1997, 5.9% between 1998 and 2007, 6.2%, 6.6%, and 6.7 in 2008, 2009, and 2010, then staying at 6.9% in 2011-2013. For the United States, they estimate it as being 5.8% on average between 1988 and 1997, 5.5% between 1998 and 2007, 5.8% in 2008, 6.0% in 2009, and then staying at 6.1% from 2010 to 2013. They also estimate the NAIRU for other countries.

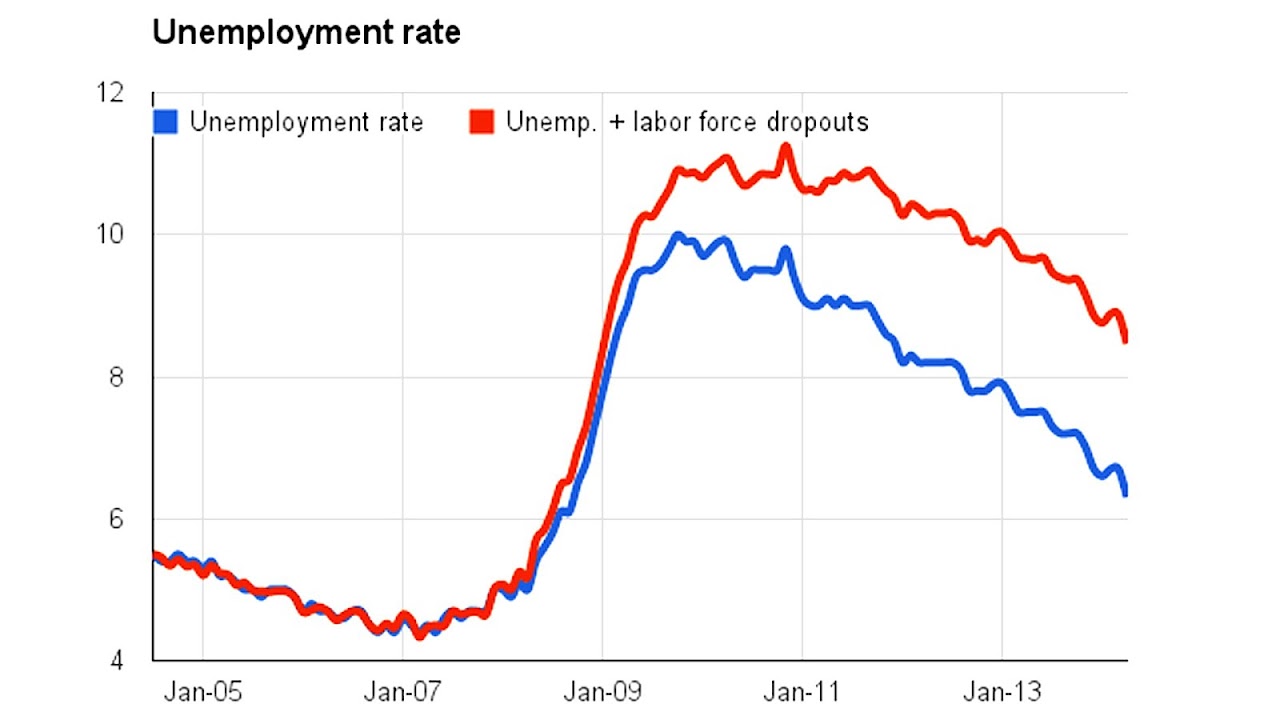

The era after the 2007-2009 Great Recession shows the relevance of this concept, for example as seen in the United States. On the one hand, in 2013 Keynesian economists such as Paul Krugman of Princeton University see unemployment rates as too high relative to full employment and the NAIRU and thus favor increasing the aggregate demand for goods and services and thus labor in order to reduce unemployment. On the other hand, pointing to shortages of some skilled workers, some businesspeople and Classical economists suggest that the U.S. economy is already at full employment, so that any demand stimulus will lead to nothing but rising inflation rates. One example was Narayana Kocherlakota, President of the Minneapolis Federal Reserve Bank, who has since changed his mind.

Unemployment and inflation

"Ideal" unemployment

An alternative, more normative, definition (used by some labor economists) would see "full employment" as the attainment of the ideal unemployment rate, where the types of unemployment that reflect labor-market inefficiency (such as mismatch or structural unemployment) do not exist. That is, only some frictional or voluntary unemployment would exist, where workers are temporarily searching for new jobs and are thus voluntarily unemployed. This type of unemployment involves workers "shopping" for the best jobs at the same time that employers "shop" for the best possible employees to serve their needs. Its existence can allow the best possible correspondence between workers and jobs from the points of view of both employees and employers and thus promotes the economy's efficiency.

Unemployment at Beveridge Full Employment

William Beveridge defined "full employment" as where the number of unemployed workers equaled the number of job vacancies available (while preferring that the economy be kept above that full employment level in order to allow maximum economic production). But the point is that this definition allows for some unemployment. To see this, assume that frictional and mismatch unemployment can be separated. At Beveridge full employment, in the case of frictional unemployment the number of job-seekers corresponds to an equal number of job openings: as discussed above, the unemployed are "shopping" for the best possible jobs (as long as the cost of job-search is less than the expected benefit) at the same time that employers are "shopping" for the best possible employees to fill the vacancies. Similarly,at Beveridge full employment, the number of people suffering from mismatch or structural unemployment equals the number of vacancies. The problem here is that the skills and geographical locations of the unemployed workers does not correspond to the skill requirements and locations of the vacancies. In theory, Beveridge's concept full employment corresponds to that of Keynes (discussed above).

The situation with less than full employment in Beveridge's sense results either from "Classical" unemployment or "neoclassical" unemployment or from Keynesian deficient-demand unemployment. In terms of supply and demand, Classical or neoclassical unemployment results from the actual real wage exceeding the equilibrium real wage, so that the quantity of labor demanded (and the number of vacancies) is less than the quantity of labor supplied (and the number of unemployed workers). In the Classical theory, the problem is that real wages are rigid, i.e., do not fall due to an excess supply of labor. In theory, this might happen because of minimum wage laws and other interference with "free markets" that prevent the attainment of market perfection. Classical economists favor making labor markets more like the ideal competitive market--and so making real wages more flexible--in order to deal with this kind of unemployment.

The neoclassical theory, in contrast, follows John Maynard Keynes and more importantly, Milton Friedman to blame inflexible money or nominal wages for low employment relative to full employment. If the money wage is fixed, the real wage is fixed for any given average price level, so that rigid money wages have the same effect as rigid real wages when the price level is given. In this case, however, real wages can be depressed (and Beveridge full employment restored) if prices rise relative to nominal wages. Alternatively, people could wait for the persistence of high unemployment to eventually cause money wages to fall. This would have the same effect, reducing real wages and increasing the quantity of labor demanded. One of the big debates in macroeconomics is whether it is better to deal with neoclassical unemployment using a small amount of inflation or by waiting for markets to adjust.

In contrast, Keynesian deficient-demand unemployment (as explained by Don Patinkin) sees a situation with less than full employment (following Beveridge's definition) as possibly prevailing even if the actual real wage is equal to the equilibrium real wage at full employment. The problem is that the demand for final products is limited by aggregate demand failure. Low demand for products (below potential output) implies that there is a sales constraint on the labor market to the left of equilibrium so that the quantity of labor demanded is below the amount that would be demanded if the aggregate demand for products was sufficient (what Robert Clower called the notional demand for labor). In terms of neoclassical theory, the prevailing real wage is less than the marginal physical product of labor in this situation. In the absence of the sales constraint, profit-maximizing employers would hire unemployed workers as long as this inequality is true, moving the labor markets toward full employment. However, the sales constraint means that the extra product of these workers could not be sold. Thus, employers would not hire the unemployed until aggregate demand rose, which would shift the sales constraint to the right, allowing more employment of labor. In this situation, Keynesians recommend policies that raise the aggregate demand for final products and thus the aggregate demand for workers.

The economic literature concerning the Phillips Curve and the NAIRU moved away from the direct examination of labor market to focus instead on the behavior of inflation rates at different unemployment rates. That is, while Beveridge and Keynes saw full-employment unemployment as where the supply of and the demand for labor were in balance, later views saw it as a threshold which should not be crossed, since low unemployment causes serious inflation.

The Phillips curves

The theories behind the Phillips curve pointed to the inflationary costs of lowering the unemployment rate. That is, as unemployment rates fell and the economy approached full employment, the inflation rate would rise. But this theory also says that there is no single unemployment number that one can point to as the "full employment" rate. Instead, there is a trade-off between unemployment and inflation: a government might choose to attain a lower unemployment rate but would pay for it with higher inflation rates. In essence, in this view, the meaning of "full employment" is really nothing but a matter of opinion based on how the benefits of lowering the unemployment rate compare to the costs of raising the inflation rate.

Though their theory had been proposed by the Keynesian economist Abba Lerner several years before (Lerner 1951, Chapter 15), it was the work of Milton Friedman, leader of the monetarist school of economics, and Edmund Phelps that ended the popularity of this concept of full employment. In 1968, Friedman posited the theory that full employment rate of unemployment was '''unique''' at any given time. He called it the "natural" rate of unemployment. Instead of being a matter of opinion and normative judgment, it is something we are stuck with, even if it is unknown. As discussed further, below, inflation/unemployment trade-offs cannot be relied upon. Further, rather than trying to attain full employment, Friedman argues that policy-makers should try to keep prices stable (meaning a low or even a zero inflation rate). If this policy is sustained, he suggests that a free-market economy will gravitate to the "natural" rate of unemployment automatically.

The NAIRU

In an effort to avoid the normative connotations of the word "natural," James Tobin (following the lead of Franco Modigliani), introduced the term the "Non-Accelerating Inflation Rate of Unemployment" (NAIRU), which corresponds to the situation where the real gross domestic product equals potential output. It has been called the "inflation threshold" unemployment rate or the inflation barrier. This concept is identical to Milton Friedman's concept of the "natural" rate but reflects the fact that there is nothing "natural" about an economy. The level of the NAIRU depends on the degree of "supply side" unemployment, i.e., joblessness that can't be abolished by high demand. This includes frictional, mismatch, and Classical unemployment. When the actual unemployment rate equals the NAIRU, there is no cyclical or deficient-demand unemployment. That is, Keynes' involuntary unemployment does not exist.

To understand this concept, start with the actual unemployment equal to the NAIRU. Then, assume that a country's government and its central bank use demand-side policy to reduce the unemployment rate and then attempt to keep the rate at a specific low level: rising budget deficits or falling interest rates increase aggregate demand and raise employment of labor. Thus, the actual unemployment rate falls, as going from point A to B in the nearby graph. Unemployment then stays below the NAIRU for years or more, as at point B. In this situation, the theory behind the NAIRU posits that inflation will accelerate, i.e. get worse and worse (in the absence of wage and price controls). As the short-run Phillips curve theory indicates, higher inflation rate results from low unemployment. That is, in terms of the "trade-off" theory, low unemployment can be "bought," paid for by suffering from higher inflation. But the NAIRU theory says that this is not the whole story, so that the trade-off breaks down: a persistently higher inflation rate is eventually incorporated as higher inflationary expectations. Then, if workers and employers expect higher inflation, it results in higher inflation, as higher money wages are passed on to consumers as higher prices. This causes the short run Phillips curve to shift to the right and upward, worsening the trade-off between inflation and unemployment. At a given unemployment rate, inflation accelerates. But if the unemployment rate rises to equal the NAIRU, we see higher inflation than before the expansionary policies, as at point C in the nearby diagram. The fall of the unemployment rate was temporary because it could not be sustained. In sum, the trade-off between inflation and unemployment cannot be relied upon to be stable: taking advantage of it causes it to disappear. This story fits the experience of the United States during the late 1960s, during which unemployment rates stayed low (below 4% of the civilian labor force) and inflation rates rose significantly.

Second, examine the other main case. Again start with the unemployment rate equal to the NAIRU. Then, either shrinking government budget deficits (or rising government surpluses) or rising real interest rates encourage higher unemployment. In this situation, the NAIRU theory says that inflation will get better (decelerate) if unemployment rates exceed the NAIRU for a long time. High unemployment leads to lower inflation, which in turn causes lower inflationary expectations and a further round of lower inflation. High unemployment causes the short-run inflation/unemployment trade-off to improve. This story fits the experience of the United States during the early 1980s (Paul Volcker's war against inflation), during which unemployment rates stayed high (at about 10% of the civilian labor force) and inflation rates fell significantly.

Finally, the NAIRU theory says that the inflation rate does not rise or fall when the unemployment equals the "natural" rate. This is where the term NAIRU is derived. In macroeconomics, the case where the actual unemployment rate equals the NAIRU is seen as the long-run equilibrium because there are no forces inside the normal workings of the economy that cause the inflation rate to rise or fall. The NAIRU corresponds to the long-run Phillips curve. While the short-run Phillips curve is based on a constant rate of inflationary expectations, the long-run Phillips curve reflects full adjustment of inflationary expectations to the actual experience of inflation in the economy.

As mentioned above, Abba Lerner had developed a version of the NAIRU before the modern "natural" rate or NAIRU theories were developed. Unlike the currently dominant view, Lerner saw a range of "full employment" unemployment rates. Crucially, the unemployment rate depended on the economy's institution. Lerner distinguished between "high" full employment, which was the lowest sustainable unemployment under incomes policies, and "low" full employment, i.e., the lowest sustainable unemployment rate without these policies.

Further, it is possible that the value of the NAIRU depends on government policy, rather than being "natural" and unvarying. A government can attempt to make people "employable" by both positive means (e.g. using training courses) and negative means (e.g. cuts in unemployment insurance benefits). These policies do not necessarily create full employment. Instead, the point is to reduces the amount of mismatch unemployment by facilitating the linking of unemployed workers with the available jobs by training them and or subsidizing their moving to the geographic location of the jobs.

In addition, the hysteresis hypothesis says that the NAIRU does not stay the same over time--and can change due to economic policy. A persistently low unemployment rate makes it easier for those workers who are unemployed for "mismatch" reasons to move to where the jobs are and/or to attain the training necessary for the available vacancies (often by getting those jobs and receiving on-the-job training). On the other hand, high unemployment makes it more difficult for those workers to adjust, while hurting their morale, job-seeking skills, and the value of their work skills. Thus, some economists argue that British Prime Minister Margaret Thatcher's anti-inflation policies using persistently high unemployment led to higher mismatch or structural unemployment and a higher NAIRU.

Uncertainty

Whatever the definition of full employment, it is difficult to discover exactly what unemployment rate it corresponds to. In the United States, for example, the economy saw stable inflation despite low unemployment during the late 1990s, contradicting most economists' estimates of the NAIRU.

The idea that the full-employment unemployment rate (NAIRU) is not a unique number has been seen in recent empirical research. Staiger, Stock, and Watson found that the range of possible values of the NAIRU (from 4.3 to 7.3% unemployment) was too large to be useful to macroeconomic policy-makers. Robert Eisner suggested that for 1956-95 there was a zone from about 5% to about 10% unemployment between the low-unemployment realm of accelerating inflation and the high-unemployment realm of disinflation. In between, he found that inflation falls with falling unemployment.

Policy

The active pursuit of national full employment through interventionist government policies is associated with Keynesian economics and marked the postwar agenda of many Western nations, until the stagflation of the 1970s.

Australia

Australia was the first country in the world in which full employment in a capitalist society was made official policy by its government. On May 30, 1945, The Australian Labor Party Prime Minister John Curtin and his Employment Minister John Dedman proposed a white paper in the Australian House of Representatives titled Full Employment In Australia, the first time any government apart from totalitarian regimes had unequivocally committed itself to providing work for any person who was willing and able to work. Conditions of full employment lasted in Australia from 1941 to 1975. This had been preceded by the Harvester Judgment (1907), establishing the basic wage (a living wage); while this earlier case was overturned, it remained influential.

United States

The United States is, as a statutory matter, committed to full employment; the government is empowered to effect this goal. The relevant legislation is the Employment Act (1946), initially the "Full Employment Act," later amended in the Full Employment and Balanced Growth Act (1978). The 1946 act was passed in the aftermath of World War II, when it was feared that demobilization would result in a depression, as it had following World War I in the Depression of 1920-21, while the 1978 act was passed following the 1973-75 recession and in the midst of continuing high inflation.

The law states that full employment is one of four economic goals, in concert with growth in production, price stability, balance of trade, and budget, and that the US shall rely primarily on private enterprise to achieve these goals. Specifically, the Act is committed to an unemployment rate of no more than 3% for persons aged 20 or over, and not more than 4% for persons aged 16 or over (from 1983 onwards), and the Act expressly allows (but does not require) the government to create a "reservoir of public employment" to affect this level of employment. These jobs are required to be in the lower ranges of skill and pay so as to not draw the workforce away from the private sector.

However, since the passage of this Act in 1978, the US has, as of 2012 never achieved this level of employment on the national level, though some states have neared it or met it, nor has such a reservoir of public employment been created.

Job guarantee

Some, particularly Post-Keynesian economists have suggested ensuring full employment via a job guarantee program, where those who are unable to find work in the private sector are employed by the government, the stock of thus employed public sector workers fulfilling the same function as the unemployed do in controlling inflation, without the human costs of unemployment.

Source of the article : Wikipedia

EmoticonEmoticon